How Does the Matching Gift Process Work? A Simplified Look

By Adam Weinger of Double the Donation

Imagine a world where every act of generosity creates a chain of goodwill, leading to increased support. Corporate matching gift programs make this dream a reality!

Through these programs, businesses match their employees’ charitable donations. That means an initial gift of $100 could double to $200 with a corporate match. With that extra $100, your nonprofit can purchase personal care items for its shelter, pay its electric bill, or buy decorations for a fundraising event.

However, some nonprofits shy away from corporate giving programs since the process seems complex. We’re here to demystify matching gifts, so you can add them to your fundraising flow.

Though the matching gift process varies across companies, it generally follows the same procedures. Here’s a detailed look at how this process generally unfolds.

1. A Donor Gives To Your Nonprofit.

First, an individual donor makes a financial contribution to your nonprofit. Various types of donations are typically eligible. Depending on their company’s rules, an individual might give via:

Cash donation

Online giving page

Direct mail

Securities like stocks

Nonprofits Source’s corporate giving guide explains that one in three donors will give more than initially planned when they know their gift is match-eligible.

While your nonprofit should always keep accurate donation records, it’s especially important with matching gifts. Information about the donor’s gift will be needed for verification later.

2. The Donor Researches Their Matching Gift Eligibility.

To determine if they are match-eligible, donors need to check their employers’ guidelines. These guidelines can usually be found on a company’s CSR or employee benefits webpage. Alternatively, employees may need to contact their company’s HR department.

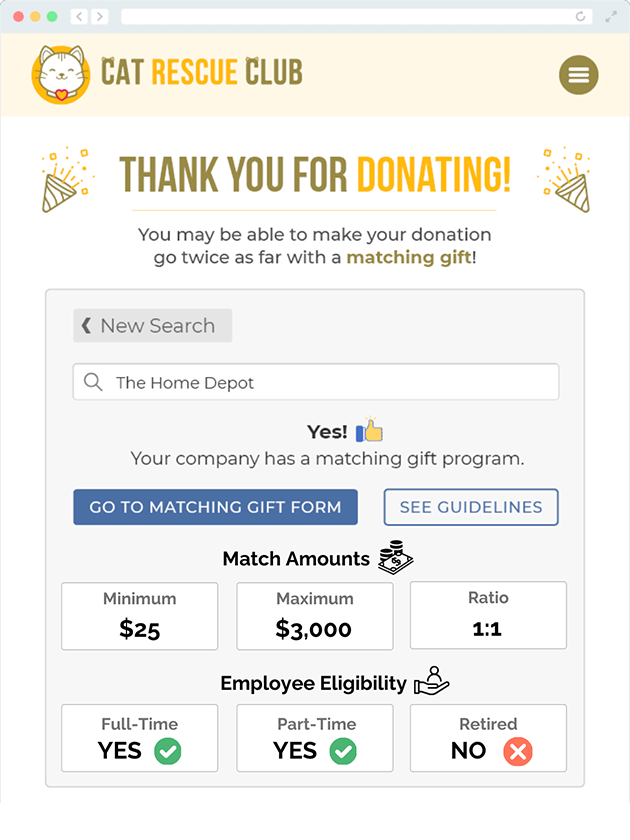

Simplify this step with matching gift tools. With a searchable matching gift database, donors can enter their employers’ names and instantly find:

Minimum and maximum match amounts: Companies often set a minimum and maximum donation amount eligible for matching, such as $25 to $3,000 per year.

Match ratios: This is the rate at which a company will match donations. A 1:1 ratio means that a company will match donations dollar-for-dollar. Some companies provide a more generous ratio of 2:1, which equates to the company donating twice as much as their employees. Others have less generous match ratios, such as 0.5:1.

Employee eligibility: Some companies only offer matching gifts to full-time employees, while others extend the program to part-time employees, retirees, and spouses.

Nonprofit eligibility: Companies may restrict what types of nonprofits are eligible for their matching gift programs. For example, religious organizations are often excluded.

Deadlines: This is the date by which employees should submit their match requests, such as one year after the donation.

Embed your matching gift search tool into key spots on your nonprofit’s website, like your Ways to Give page. You can also create a dedicated matching gift page to host your search tool.

Some matching gift software solutions even trigger follow-up emails based on an individual’s match eligibility. For example, someone who is match-eligible may receive an email with a link to their employer’s match request form. Meanwhile, someone whose eligibility is unknown may receive an email prompting them to research their employer’s program.

An Example of Matching Gift Guidelines

Companies’ guidelines can get complicated, and your software can make all the difference! 360MatchPro’s list of CSR examples shares an excellent example of complicated guidelines. Deloitte provides industry-leading audit, consulting, tax, and advisory services. While their matching gift program is generous, its guidelines are somewhat complicated:

The minimum donation amount that will be matched is $50 or above for employees and $250 or above for active or retired Deloitte partners, principals, and managing directors.

Only full-time and retired employees are eligible.

Employees at Deloitte must collectively donate $1,000 or more within the fiscal year for any matches to be made.

The total program budget for matching is $32,500 per year.

The match ratio is 1:1.

Gifts must be designated to academic programs or funds.

Matching gift requests must be submitted online by May 31.

Luckily, most guidelines are more straightforward. If you can’t understand a company’s guidelines, you can overcome that challenge by asking the company directly.

3. The Donor Submits A Matching Gift Request

The actual match request process varies from company to company, but here’s how it typically works when a CSR platform is used:

A donor logs into their company’s employee giving portal. Companies with CSR software have an online portal where employees can log in to request matches.

The employee searches for your nonprofit. The giving portal will prompt them to search for your organization within an online database by providing the city, state, tax ID, zip code, and so on. We recommend nonprofits provide as much of this information as possible on their donation receipts.

The individual selects your nonprofit from the search results. If they can’t find your organization, they might be able to enter your nonprofit’s information manually.

They report their donation. The donor will provide information about their gift like the payment type, amount, date, and whether it was designated to a specific program.

The donor submits the request. The platform will ask them to review the information they provided and submit their request.

Thanks to auto-submission, some donors can skip this step in the matching gift process. As the latest innovation in corporate giving technology, auto-submission enables donors to click a checkbox on your online donation form to allow your matching gift software to automatically complete their match requests. There’s just one catch: the company’s CSR software must integrate with your matching gift tools.

While still fairly new, this feature can reduce manual errors and lead to more donors requesting and completing matching gifts!

4. The Company Reaches Out To Verify The Donation.

Your donor’s work is done! Now, it’s up to your nonprofit and the company to complete their respective steps.

The employer will review the match request and decide whether the donation meets the match criteria. In some cases, a gift receipt will be enough, while others may require additional documentation like a donor acknowledgment letter or a copy of the donation check.

If a company requests verification from your team, respond quickly. You might need to confirm the donation amount, the date it was made, and the donor’s identity. All of this information should be recorded in your donor database from step one.

5. The Company Submits The Match.

If everything’s in line, the company will approve the matching gift and release the matching funds. Be aware that companies have varying disbursement schedules. While some distribute matching gift funds monthly or quarterly, others manage all matching gifts at the end of the fiscal year. While less common, some smaller companies or those with less formal programs may disburse matching gifts as soon as they are verified.

The matching funds are sent to your nonprofit, typically through:

Direct deposit

Mailed check

CSR platforms like Benevity or YourCause

Credit card donations

Your nonprofit can even track completed matches and monitor donor engagement with its technology.

Be prepared to accommodate different payment methods, so you can handle these transactions efficiently.

Next Steps

That’s it! While not required, you can also reach out to thank the donor for taking the time to complete the matching gift process. After all, showing appreciation is the best way to get your matching gift donors to stick around. Send a thoughtful eCard or personalized letter expressing how the increased contribution will impact your cause.

To start simplifying the matching gift process, invest in matching gift software, spread the word to your donors about matching gifts, and educate your staff about matching gifts so they can answer donors’ questions.

This guest post was written by Adam Weinger.

Adam Weinger is the President of Double the Donation, the leading provider of tools to nonprofits to help them raise more money from corporate matching gift and volunteer grant programs.

Double the Donation's robust solution, 360MatchPro, provides nonprofits with automated tools to identify match-eligible donors, drive matches to completion, and gain actionable insights. 360MatchPro integrates directly into donation forms, CRMs, social fundraising software, and other nonprofit technology solutions to capture employment information and follow up appropriately with donors about matching gifts.