3 Ways to Protect Donors Through Nonprofit Compliance

By Greg McCray of Foundation Group

With only 20% of people reporting a high level of trust in charities, nonprofit leaders have to prioritize proving their organizations' trustworthiness. While your nonprofit depends on donors to drive its mission forward, donors depend on you to protect their sensitive information and generous gifts.

When it comes to protecting your donors, the first place to start is with nonprofit compliance. After all, donors can’t be confident that your organization is doing the right thing if you don’t follow the basic rules of starting and operating a nonprofit. Let’s explore three ways your nonprofit can protect donors while complying with state and federal regulations.

1. Charitable Solicitations Registration

Sharing your nonprofit’s financial needs is not just helpful for garnering support but also for protecting donors’ gifts by showing that their funds will go to worthwhile causes. But before you solicit even a dollar from supporters, your nonprofit may need to register for charitable solicitations.

The charitable solicitations registration requirement for nonprofits was designed to protect donors from contributing to illegitimate organizations with non-charitable causes. Registering with the states in which you’ll fundraise shows donors the legitimacy of your fundraising efforts while bolstering confidence in your ability to make an impact with their donations.

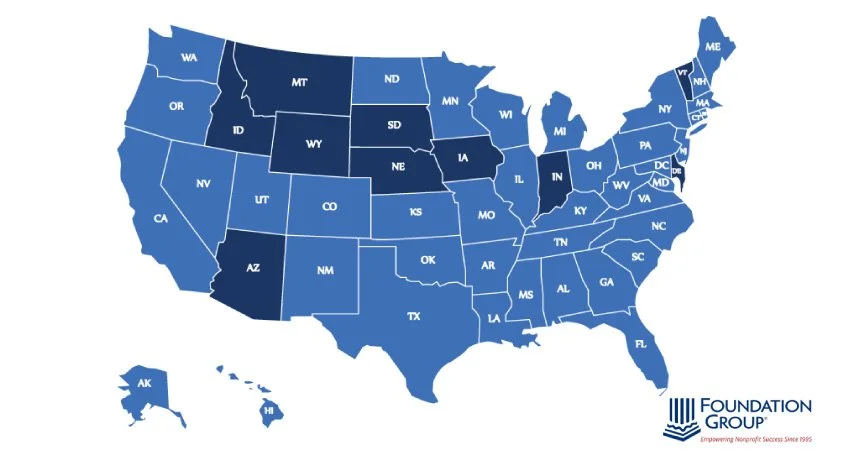

While the majority of states require nonprofits to register, there are 10 that don’t:

Arizona

Delaware

Idaho

Indiana

Iowa

Montana

Nebraska

South Dakota

Vermont

Wyoming

If your nonprofit fundraises in multiple states where registration is required, you may have to complete the registration in each state. When your fundraising ask is backed by the approval of multiple states, donors will be reassured that your nonprofit’s efforts are legitimate.

To further show your commitment to responsibly stewarding charitable contributions, be transparent online about how your nonprofit uses or plans to use donations.

For example, Double the Donation recommends making your annual report available on your nonprofit’s website to serve as a resource for both existing and potential supporters. Plus, if you leverage marketing tools like Google’s Ad Grant program, proof of your compliance will reach an even larger audience.

2. Secure Data Collection

We all know that donor data is a valuable tool for nonprofit marketing strategies, but it’s also a crucial component of compliance.

When making donations or otherwise contributing to your organization, supporters share their full names, addresses, contact information, payment information, and other personal details. As a result, your nonprofit gains access to highly sensitive donor data. While you’ll have to use this information for numerous compliance purposes, it’s crucial to collect and use data responsibly to ensure you don’t compromise any donor information.

For starters, you may be required to report certain donor information when filing Form 990. Schedule B, or the Schedule of Contributors, requires 501(c)(3) organizations to report the following donor information:

Names

Addresses

Amounts given

According to Foundation Group’s filing guide, this data is also necessary to calculate your annual public support percentage. This means different individuals on your nonprofit’s team will work with donor data to submit tax filings, evaluate sources of support, and otherwise manage your organization’s funding.

To protect this information, use reliable software that employs effective security measures. For example, invest in a CRM with a PCI-compliant payment processor to ensure donors can safely input their payment information online. Additionally, restrict data access to only the staff members or leaders who need it to fulfill their responsibilities.

3. Effective Bookkeeping

While your nonprofit’s revenue path is greatly defined by the type of donations you receive, effective bookkeeping can guide your financial journey to help you make the most of your funding. Of equal importance, it can also protect donors’ contributions from being misused.

Bookkeeping is essential to complying with nonprofit standards, such as financial transparency and tax requirements. Also, failing to handle your funding wisely can result in the misappropriation of funds, even unintentionally. By maintaining thorough and accurate records, your nonprofit ensures each donation is used for its intended purpose.

To get started with compliant bookkeeping, follow these steps:

Keep thorough records. Each one of your nonprofit’s transactions must be recorded in as much detail as possible for effective bookkeeping. When it comes to donors’ contributions, note the type of donation received, the source of the donation, and any other relevant information about the gift.

Stick to a budget. Use the details recorded about your transactions to develop a plan for using your nonprofit’s funding. A roadmap for your finances ensures you put every cent toward your mission and your organization’s ability to fulfill it, and it holds staff members accountable for their spending.

Produce financial statements. Gather insights from your nonprofit’s financial data by compiling a Statement of Activities, a Statement of Financial Position, and a Statement of Cash Flows. This information is another way to maintain financial transparency and can also help your nonprofit adjust its budget as necessary to meet future goals.

Since your focus is likely on fulfilling your mission, consider outsourcing your bookkeeping needs to a professional. Expert bookkeepers have access to top-tier bookkeeping software and are familiar with state and federal rules regarding nonprofit finances. That way, your nonprofit’s leaders can stick to their areas of expertise. Plus, a third party’s supervision over your books can further ensure financial accountability.

Aside from protecting your donors and complying with nonprofit regulations, these practices can also boost your fundraising success! You’ll see greater fundraising results when donors know they can trust your organization.

Make fundraising a breeze by highlighting your nonprofit’s efforts to protect donors and being transparent about how you use their contributions. Tell the stories of beneficiaries, share impact reports, and include credible statistics in your marketing materials. By sharing these important (and reliable) facts, your nonprofit will maintain compliance, prove its trustworthiness, and ultimately maximize its impact.

This guest post was written by Greg McCray.

Greg is the founder and CEO of Foundation Group, one of the nation's top providers of tax and compliance services to nonprofits. Greg and his team have worked with tens of thousands of nonprofits for over 25 years, assisting them with formation of new charities, plus tax, bookkeeping, and compliance services. He is credentialed as an Enrolled Agent, the highest designation of tax specialist recognized by the Internal Revenue Service. Based in Nashville, Tennessee, Greg and company work with charities and nonprofits all across the country and worldwide.