How To Fix Your Nonprofit’s Cash Flow

Nonprofit CEOs: Are you forced to tap into your line of credit every year at the same time?

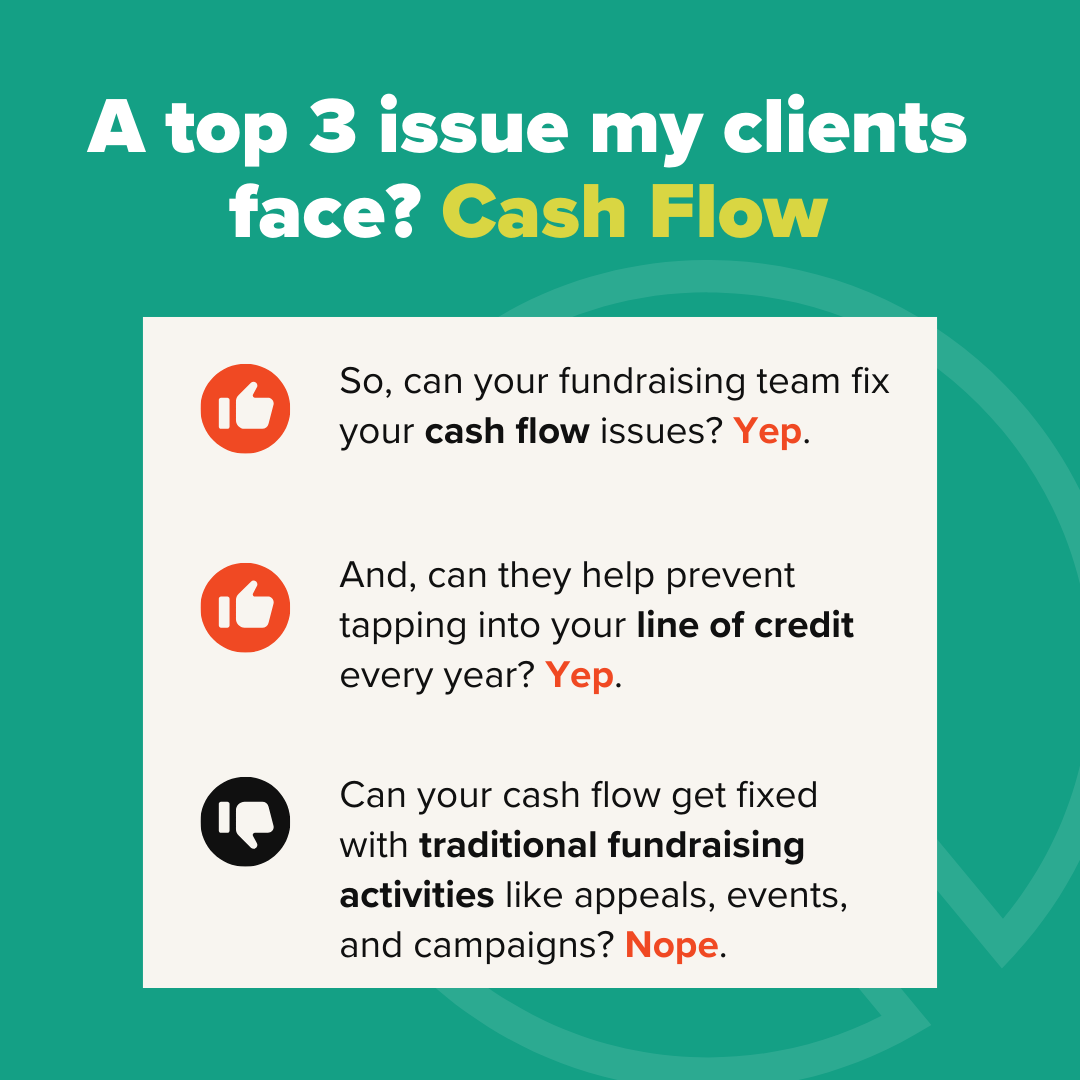

If you’ve wondered if fundraising can fix your CASH FLOW, you’re asking the right question. But, nobody’s really talking about this issue, but it’s a top 3 concern among nonprofits leaders I work with.

IF YOU KNOW YOU KNOW…

📆Reimbursement from Gov Grants are ridiculously slow

📆Program revenue floats you for 10 months (but month 11 & 12 are another story)

📆Project-based money is great for THAT project but $ restrictions cause other problems (hello, payroll)

So, can your fundraising team fix your cash flow issues?

👍🏼Yep.

And, can they help prevent tapping into your line of credit every year?

👍🏼Yep.

Can your cash flow get fixed with traditional fundraising activities like appeals, events, and campaigns?

👎🏼Nope.

YOUR NONPROFIT’S CASH FLOW WILL GET FIXED ONLY IF YOU:

1. Create an honest multi-year, needs-based budget as your north star

2. Use a high-ROI funding model to influence every aspect of your business that touches revenue

3. Train your team to attract, lead, and secure large unrestricted gifts

Can I be blunt?

All of this advice means your fundraising team MUST know how to have investment-level conversations. They must answer the numbers questions well. Intimately know your finances. Understand your multi-year projections.

But, I rarely see this.

I see too many fundraisers depending on emotional appeals. The story. The heart-strings. They must do that too. But, investment-level donors need more.

👉🏼Fix this and you’ll see the millions of dollars you’ve been leaving on the table.

👉🏼Fix this and you fix your cash flow.

Whenever you’re ready, here are THREE things you can do next:

👣 Follow me on LinkedIn where I share the same lessons I teach my clients about attracting larger gen-ops dollars and adding 7-figures + to their bottom line.

🍎 Read my GUIDE! THE TRUTH ABOUT GIVE/GETS :: Top 5 Reasons Your Board’s Give/Get Is Leaving Thousands (Sometimes Millions) on the Table. See how limiting board members to the Give/Get model restricts gifts and keeps your staff from reaching their full fundraising potential. Here to get it.

📈 Work with me to scale your org's revenue by 2-5X and fund your organization’s Strategic Plan // If you’re a business-minded CEO already raising MILLIONS but need to diversify revenue and secure more general-operating dollars to invest in growth, you can apply to work with me here.